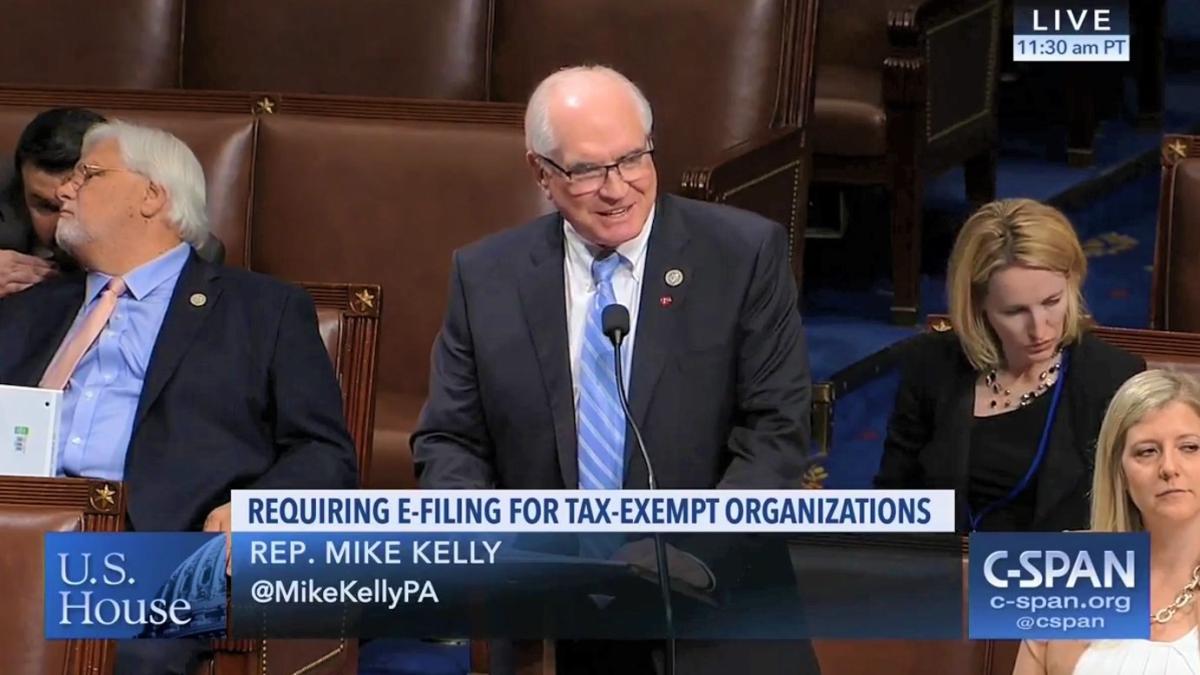

Rep. Kelly Hails House Passage of IRS Reform Package to Put Taxpayers First

Kelly bill to protect Americans from charity fraud passes unanimously

WASHINGTON — U.S. Representative Mike Kelly (R-PA) – a member of the House Ways and Means Committee – voted this week in support of a series of bills to reform the practices and policies of the Internal Revenue Service (IRS), also known as the “Taxpayer First” IRS Reform Package. Among the bills passed this evening by the House of Representatives were H.R. 5444, the Taxpayer First Act, and H.R. 5445, the 21st Century IRS Act. Yesterday the House unanimously passed H.R. 5443, a bipartisan bill introduced by Rep. Kelly and co-sponsored by Rep. Stephanie Murphy (D-FL) to change IRS policy to require all non-profit charitable giving organizations to electronically file their 990 forms — the forms used annually by tax-exempt organizations — and require the IRS to make these electronic filings available to the public in machine-readable format.

Statement by Rep. Kelly:

“When it comes to charitable giving, the United States is the most generous nation on Earth. That makes it all the more important to ensure that Americans are protected from scammers who despicably steal well-intended donation money from the people and causes that actually need them. By instituting an e-filing policy for all charitable giving organizations, we can help reduce fraud and increase accuracy, efficiency, and accountability throughout the giving community. This will also help eliminate paperwork, reduce IRS administrative costs, and ultimately save taxpayer money. I thank my colleague Rep. Murphy for working with me on this bipartisan bill to use the joint power of technology and transparency to more easily crack down on bad actors and punish those who shamefully abuse charity for personal gain.”

Statement by Rep. Murphy:

“Millions of Americans contribute to charitable organizations every year, and they deserve assurance that their hard-earned money will be used the way it was intended. Charity scams hurt the ability of legitimate organizations to raise funds and awareness for important causes. This bill will make it easier for the government to identify, shut down, and prosecute scam organizations that use charitable contributions for their personal benefit, rather than to help those in need. I’m proud to file this bipartisan bill with Congressman Kelly to help charitable donations fulfill their important missions.”

Statement by National Association of State Charity Officials President Karen Gano:

“Having electronic data for all Form 990 filers is necessary in order to fully realize these potential savings for charities, and to ensure that the states have ability to identify and stop fraudulent activity that harms charities and donors more quickly and effectively.”

Excerpts of Rep. Kelly’s floor speech:

“In my own congressional district in Western Pennsylvania, we have many wonderful organizations that demonstrate the power of giving each and every day. In Erie, Pennsylvania, we have the Erie Community Foundation, the United Way of Erie, and the Black Family Foundation. A businessman in the energy sector, Pat Black started a small private foundation in 1993. He is just one individual who took it upon himself to create a charitable organization to give back to his community. And we have many other good corporate citizens in Erie such as Erie Insurance. More than a half century ago, Erie Insurance’s founder, H.O. Hirt, had a lifelong concern for others less fortunate. Today, Erie Insurance and its employees have continued his tradition of giving through food and clothing drives, among other things.”

“Since it’s tax filing week, all these charitable organizations must file their [990] tax forms. … Our bill would make it mandatory that 990s be filed electronically going forward. … A readable, searchable format will help improve efficiency and accuracy—and reduce fraud. E-filing has served as a highly effective tool in exposing scam charities. And it will make it easier to catch those few bad actors who are using tax donations only for personal gain. … Charges could then be brought sooner against these scam charities in less than one year instead of four if the return information is available electronically.”

“The state of Michigan is a great model for just how valuable access to machine-readable data is. To date, Michigan has shut down the most number of scam non-profits out of all 50 states. This is because of the Michigan Attorney General’s ability to manipulate and analyze searchable data. Our bipartisan bill would help expose these scams nationally by ensuring nonprofits are e-filing annual returns.”

The Taxpayer First Act

The Taxpayer First Act will shift the balance of power back to the taxpayer. It creates an independent appeals process to review taxpayers’ disputes so they know their issues are being considered fairly and ensures equal access to information throughout the process. It provides enforcement reforms to rein in the IRS’ abuse of property seizure, and requires the agency to develop a detailed plan on how to redesign its structure by 2020. The bill also permanently extends the Free File and Volunteer Income Tax Assistance programs, which are valuable tools for low- and moderate-income Americans.

The 21st Century IRS Act

The 21st Century IRS Act will strengthen the security of the agency’s information technology systems, which date back to the 1960s. The bill will help the IRS better work with states and the private sector to confront cyber threats, and provides better support for identity theft victims by identifying a single point of contact to resolve their cases. Americans deserve the assurance that their personal information is being handled carefully and securely.

BACKGROUND

Since news of the IRS targeting scandal first broke in May 2013, Rep. Kelly has been a prominentvocalleader in the ongoing pursuit for answers and accountability. After earning a standing ovation for his fierce scolding of then-IRS commissioner Steven Miller at the Ways and Means Committee’s first-ever hearing on the scandal, The Washington Post’s Right Turn blog named Rep. Kelly its “Distinguished Pol of the Week.” The New York Post declared that Rep. Kelly’s words “ought to be emblazoned across the entryway of every IRS office in America.”

In response to the scandal, Rep. Kelly introduced the Government Employee Accountability Act, which would grant all federal agencies the power to fire reckless Senior Executive Service employees (such as ex-IRS official Lois Lerner) on the spot, or place them on “investigative leave” without pay. The legislation was passed by the House of Representatives on August 1, 2013, as part of the Stop Government Abuse Act (H.R. 2879) by a bipartisan vote of 239-176. Rep. Kelly re-introduced the bill on February 4, 2015. On February 26, 2015, Rep. Kelly introduced H.R. 1026, the Taxpayer Knowledge of IRS Investigations Act, which the House unanimously passed on April 15, 2015.

###