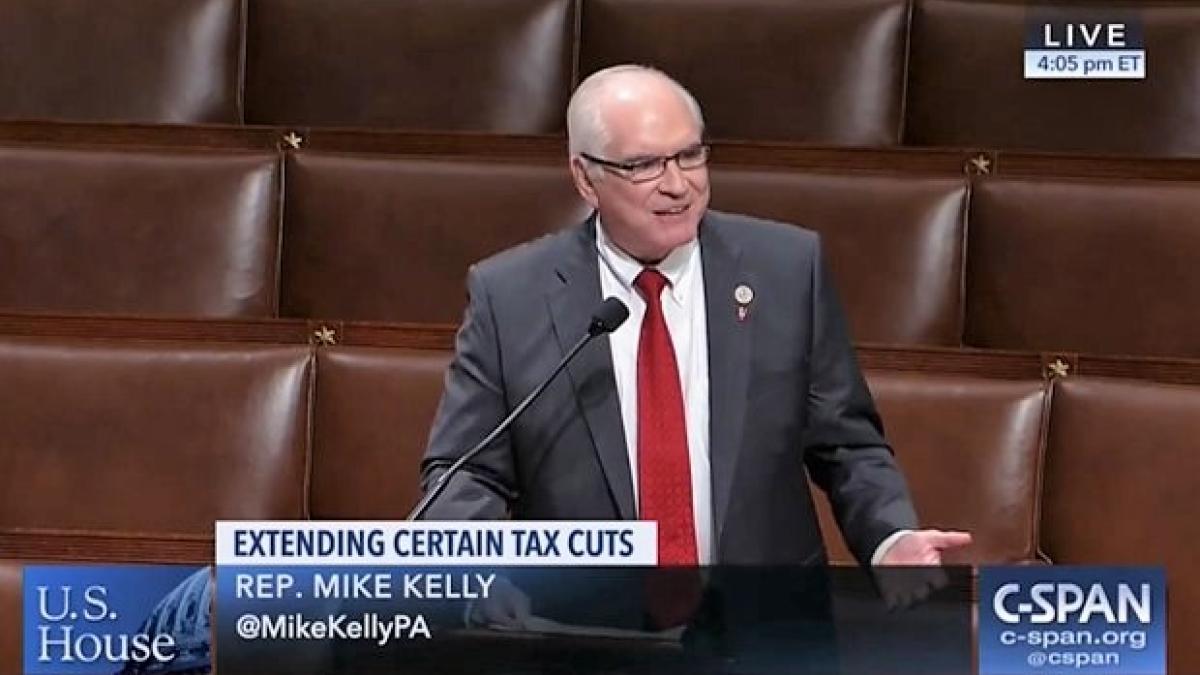

House Passes Kelly Legislation to Increase Retirement Savings for Americans

Year-end tax relief package includes text of three retirement reform bills authored by Rep. Kelly

“A secure retirement for every American should not be a partisan issue”

WASHINGTON — The U.S. House of Representatives this evening passed the Retirement, Savings, and Other Tax Relief Act of 2018 and the Taxpayer First Act of 2018 (also known as the House amendment to the Senate amendment to H.R. 88). The package includes major parts of legislation previously introduced by U.S. Representative Mike Kelly (R-PA) — founder and co-chairman of the House Retirement Security Caucus and a member of the House Ways and Means Committee — during the 115th Congress. These include the Family Savings Act of 2018 (H.R. 6757), the Retirement Enhancement and Savings Act of 2018 (H.R. 5282), and the Rightsizing Pension Premiums Act of 2017 (H.R. 3596).

Floor statement by Rep. Kelly on H.R. 88 (as prepared for delivery):

“Thank you, Mr. Speaker, for bringing this incredibly important legislation to the floor for consideration. I rise in strong support of H.R. 88, a comprehensive package that will, in many different ways, help millions of American families save more of their own money for their future.

“Among H.R. 88’s many features is a section that includes key elements of the three retirement reform bills that I have been proud to author, introduce, and champion over the last two years.

“One of those bills — the Family Savings Act — stood as one of the three pillars of Tax Reform 2.0, which this House passed with bipartisan support in September. With the passage of H.R. 88, much of that bill — along with my bipartisan Retirement Enhancement and Savings Act and my bipartisan Rightsizing Pension Premiums Act — will be one giant step closer to becoming law.

“In short, this package is a wonderful Christmas present for the American people that cannot come soon enough.

“As we know, Americans should be able to rely on three main sources of income to ensure full financial security during their retirement years: #1. Social Security, #2. Personal savings, and #3. Employer-sponsored savings plans. When it comes to that third source, an alarming number of Americans do not have access to an employer-provided 401(k) plan. And among those who do, a recent study found that 42% of them have less than $10,000 in their plan. Combined with the fact that more than 60% of Americans don’t have enough cash to cover a $1,000 emergency expense, the passage of today’s package is especially critical.

“Specifically, H.R. 88 will make it easier for small employers to pool together and offer retirement plans to their employees. This would help bridge the divide between the benefits that large employers might offer to their employees, and those that smaller employers only wish they could offer until now. Overall, this will help ensure that the next generation of Americans don’t outlive their savings in retirement.

“One of the things I remember so clearly from growing up is my parents saying to me and my siblings, ‘We never want to be a burden to you kids.’ And I thought as a young person that I could never think of my parents as a burden to me—not after everything they did for me. But just think about that for a minute: That generation – the ‘Greatest Generation’ – was telling us they never wanted to be a burden to the next generation.

“What we’re talking about today is relieving the burden on the next generation by making it easier for people to go into retirement feeling that they have enough income to enjoy their golden years. H.R. 88 will accomplish this goal by giving Americans the tools they need to help them save for the future and build a secure retirement.

“A secure retirement for every American should not be a partisan issue. So today, let us come together as a unified body and send this bill to the Senate for the sake of every American’s peace of mind during this season of peace.

“Before I conclude, I also want to highlight this bill’s inclusion of two important tax credit provisions that will specifically help my constituents in Western Pennsylvania: H.R. 88 will make permanent the Railroad Track Maintenance Tax Credit for short-line railroads, and will extend the Biodiesel Tax Credit. Each of these actions will directly support local economic growth and job creation in rural communities across America, including our district.

“Last December, Congress came together to pass historic tax reform that put more money back in the American people’s pockets. Twelve months later, let’s pass another historic bill to help them save that money for the years when they need it most! Let’s pass H.R. 88!”

General Summary of Provisions:

- Helps businesses provide retirement plans to their workers and helps families to start saving earlier and more throughout their lives. Includes provision expanding use of 529 accounts

- Modernizes the IRS and makes taxpayer service the focus of the agency by improving the ease and efficiency of the taxpayer experience when filing taxes, retrieving information, resolving issues, and making payments.

- Delay of Obamacare taxes

- 5-year delay of the Medical Device Tax

- 2-year delay of the Health Insurance Tax

- 1-year delay of the excise tax on high cost health plans (a.k.a. “the Cadillac Tax”)

- Repeal of the Tanning Tax

- Repeal of the Church Parking Tax

- Provision to allow tax-exempt charitable and educational organizations to make collegiate housing and infrastructure grants to specified tax-exempt social clubs, such as fraternities and sororities, in order to fund college and university housing.

- The Free Speech Fairness Act (repeal of the Johnson Amendment)

- Tax provisions related to disaster relief:

- Provides special rules allowing access to retirement funds, temporary suspension of limits on deductions for charitable contributions, allowance of deductions for personal casualty disaster losses, special rules for measurement of earned income for purposes of qualification for tax credits, and a special credit for employees to individuals and businesses affected by Hurricanes Florence and Michael, Typhoons Mangkhut and Yutu, California fires, Kilauea volcanic eruptions and earthquakes, and severe storms in Alabama, Hawaii, Indiana, North Carolina, Wisconsin, and Texas.

A section-by-section summary of H.R. 88 can be viewed here.

Organizations supporting H.R. 88:

60 Plus Association

AALU

AIG

Allianz Life Insurance Company of North America

American Association of Christian Schools

American Business Defense Council

American Commitment

American Council of Life Insurers

American Federation for Children

American Fraternal Alliance

Americans for Prosperity

Americans for Tax Reform

Ameritas

Archdiocese of New York

Archdiocese of Washington, DC

Arizona School Choice Trust

Association of Christian Schools International

Association of Mature American Citizens

Assurity Life Insurance Co.

AXA Equitable Holdings, Inc.

Boston Mutual Life Insurance Company

Boy Scouts of America

C.U.R.E. – Center for Urban Renewal & Education

California Catholic Conference

Campaign for Liberty

Canada Life Reinsurance

CAPE – Council for American Private Education

Catholic Education Partners

Center for a Free Economy

Center for Individual Freedom

Center for Worker Freedom

Cetera Financial Group

Children’s First Foundation

Children’s Scholarship Fund

Christian Schools International

Church Alliance

Coalition for Jewish Values

Concerned Women for America LAC

Connecticut Catholic Conference

Council for Citizens Against Government Waste

Digital Liberty

EdTaxCredit50

Ethics and Religious Liberty Commission

Faith & Freedom Coalition

Family Business Coalition

Family PAC Federal

Family Research Council – Key Vote

Fidelity Security Life Insurance Company

Florida Faith & Freedom Coalition

FreedomWorks

Genworth Financial, Inc.

Girl Scouts of the USA

Gleaner Life Insurance Society

Hannover Life Reassurance Company of America

Hawkeye Insurance Association

Hispanic Leadership Fund

Home School Legal Defense Fund

HSA Coalition

Independent Women’s Forum

Independent Women’s Voice

Insured Retirement Institute

Invest in Education Coalition

Jackson Holdings LLC

Jewish United Fund/Jewish Federation of Metropolitan Chicago

John Hancock

Lincoln Financial Group

LPL Financial

Massachusetts Mutual Life Insurance Company

Medico Insurance Company

MetLife

National Association for Fixed Annuities

National Association of Insurance and Financial Advisors

National Council of Farmer Cooperatives

National Life Group

National Rural Electric Cooperative Assoc.

National Taxpayers Union – Key Vote

Nationalwide Financial

NCEA – National Catholic Education Association

New York Family Research Foundation

New York Life Insurance Company

NTCA–The Rural Broadband Association

OneAmerica

Oxford Life Insurance Company

Pacific Life

Pan American Life Insurance Group

Penn Mutual

Principal Financial Group

Protective Life Insurance Company

Prudential Financial

Reaching America

Royal Neighbors of America

Sammons Financial Group

Securian Financial Group

Security Benefit Life Insurance Company

Small Business & Entrepreneurship Council

Symetra Life Insurance Company and Affiliates

Taxpayers Protection Alliance

Texans for Education Opportunity

Texas Public Policy Foundation

The Guardian Life Insurance Company of America

The Jewish Federations of North America

Thrivent

TIAA

Tradition Family Property, Inc.

Transamerica Corporation

UJA—Federation of New York, Inc.

United Benefits Group

Universal Guaranty Life Insurance Company

US Council of Catholic Bishops

USA Workforce Coalition

USCCB – U.S. Conference of Catholic Bishops

Voya Financial

###