Kelly, Blumenauer introduce Short Line Railroad Tax Credit Modernization Act

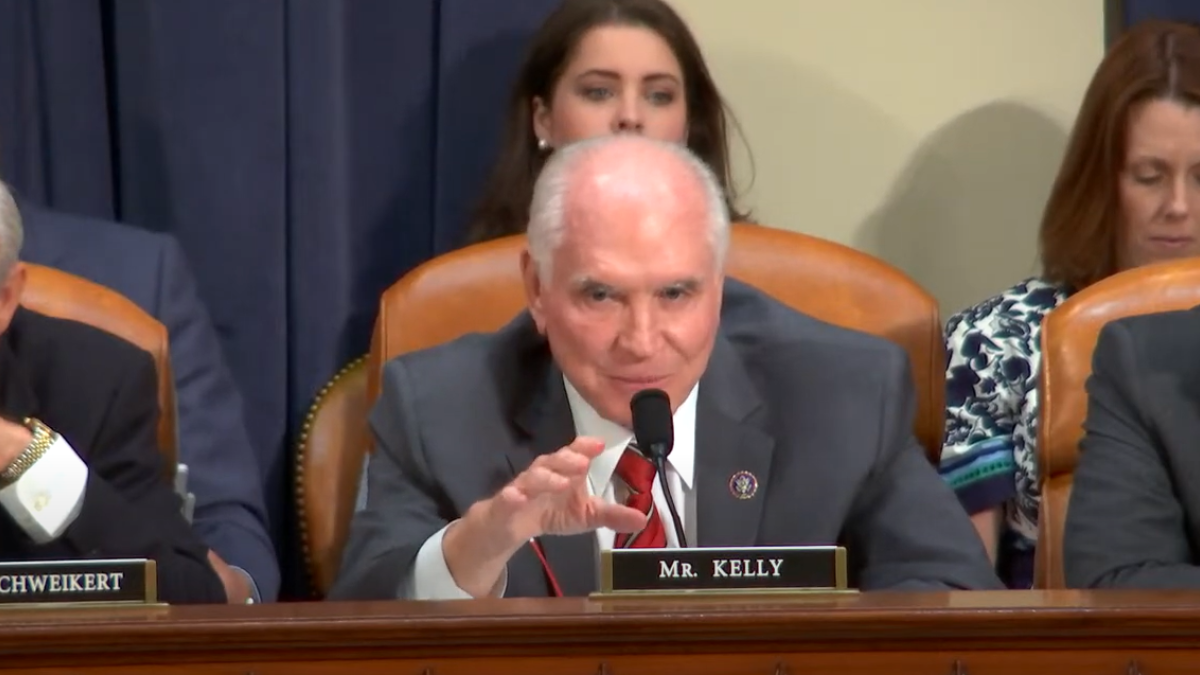

WASHINGTON, D.C. -- Today, U.S. Reps. Mike Kelly (R-PA), Chairman of the Ways & Means Subcommittee on Tax, and Earl Blumenauer (D-OR), Ranking Member of the Ways & Means Subcommittee on Trade, introduced the Short Line Railroad Tax Credit Modernization Act, legislation that would make it easier to keep local rail lines operating and in good repair and improve commerce in communities nationwide.

"Short line rail service connects communities and provides rail service in small towns nationwide, including stops throughout Western Pennsylvania," said Rep. Kelly. "In some cases, short lines provide the only source for local companies to ship their products nationally. This legislation allows rail companies to continuing to provide safe and efficient service and provides a return on taxpayer investment."

“Short line rail is absolutely critical for rural and small communities. Modernizing the railroad track maintenance credit will help to invest in this critical infrastructure that extends opportunity to the furthest reaches of our communities," said Rep. Blumenauer.

“The 45G tax credit has been a powerful incentive for short lines to put more of their own funds to work upgrading track and bridges to modern standards, a benefit for the entire interconnected freight rail network, thousands of rail shippers in critical industries, and the American public. Short lines operate one-third of the nation’s rail system, and are the origin or destination point of one in five cars moving throughout the system,” said Chuck Baker, President of the American Short Line and Regional Railroad Association (ASLRRA). “This game changing policy has been responsible for more than $8B in investment to date, but outdated caps and limitations are threatening to erode its potency. Today, four leaders in Congress have pledged to act, enabling updates to the credit that will serve the rail industry, shippers, and the economies of small towns across the country for years to come.”

You can read the bill here.

BACKGROUND

In 2020, working with Rep. Kelly and Rep. Blumenauer, secured a permanent extension of the tax credit for short line track maintenance, which had been a temporary credit for years, hampering investment.

The new bill proposes to update the Section 45G short line tax credit by increasing the tax credit available for track rehabilitation and maintenance from $3,500 per mile to $6,100 per mile. It would also make more track eligible for the credit. Under current law, eligibility is based on maps of track that was owned or leased by short line railroad operators as of 2015. The bill would expand eligibility to all track owned or leased as of 2024.

A companion bill in the Senate is co-sponsored by Senators Mike Crapo, R-ID and Ron Wyden, D-OR.