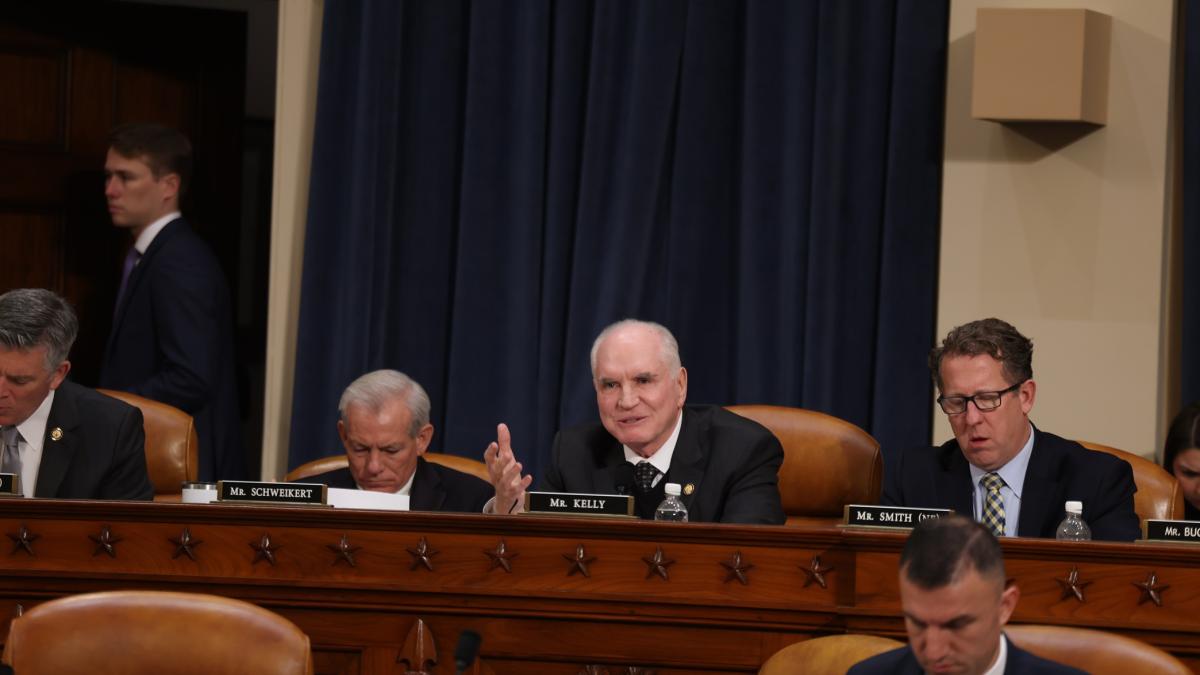

Kelly applauds House passage of One Big Beautiful Bill Act

WASHINGTON, D.C. -- Today, U.S. Rep. Mike Kelly (R-PA), Chairman of the Ways & Means Subcommittee on Tax, released the following statement after the U.S. House of Representatives passed the "One Big Beautiful Bill Act."

"Today, House Republicans fulfilled a promise to deliver tax relief to the American people. This legislation will strengthen working families and small businesses in Pennsylvania and across the United States. Parents will benefit from an expanded Child Tax Credit. We have delivered President Trump's promise of no tax on tips, overtime, auto loan interest, and tax relief for seniors. And, we are putting more money in the pockets of millions of Americans. We are building on the success of the 2017 Tax Cuts & Jobs Act and we are making sure these pro-growth tax policies will benefit generations to come," said Rep. Kelly.

BACKGROUND

The One Big Beautiful Bill Act makes permanent the successful 2017 Trump tax cuts and includes critical pro-growth policies that will cut taxes by an additional $1,300 for a family of four and deliver higher wages and incomes for millions of Americans. A recent report from the Council of Economic Advisers shows the legislation will produce up to $13,300 more in take-home pay for a typical family and up to $11,600 more in wages for American workers.

The One, Big, Beautiful Bill Is Pro-Growth Tax Policy

Permanent extension of the Trump tax cuts, alongside additional pro-growth policies, will fuel a resurgence in economic growth:

- America’s real gross domestic product (GDP) to increase by an estimated 5.2 percent over the next four years and 3.5 percent in the long term.

- 9.8 to 14.5 percent boost in investment in the next four years and a 4.9 to 7.5 percent boost in long-term investment.

- 6.6 to 7.4 million full-time jobs saved or created in the next four years and 4.2 million saved or created in the long term.

FACT SHEET: The One, Big, Beautiful Bill Fuels America’s Economic Growth

The One, Big, Beautiful Bill Makes Families & Workers Thrive Again

- Makes the 2017 Trump tax cuts permanent – protecting the average taxpayer from a 22 percent tax hike.

- Saves the average American family from a $1,700 tax hike – the equivalent of 9 weeks of groceries.

- Delivers an additional $1,300 tax cut for the average American family.

-- Delivers up to $11,600 in higher wages per worker.

-- Delivers up to $13,300 more in take-home pay for a family with two children. - Delivers on President Trump’s priorities of no tax on tips, overtime pay, car loan interest, and tax relief for seniors that will put more money annually in the pockets of millions of Americans:

-- Up to $1,750 for overtime workers.

-- $1,700 for tipped workers.

-= Up to $450 for seniors. - Locks in and boosts the doubled Child Tax Credit for more than 40 million families and provides additional tax relief for American families.

- Preserves and increases the doubled guaranteed deduction for 91 percent of all taxpayers.

- Expands 529 education savings accounts to empower American families and students to choose the education that best fits their needs, whether it is K-12 materials or obtaining a postsecondary trades credential.

- Supports working families by expanding access to childcare and making permanent the paid leave tax credit.

- Puts American families in control of their health care by expanding health savings accounts and cementing into law a Trump Administration policy that offers more choice and flexibility for health coverage options.

- Starts building financial security for America’s children at birth with the creation of new savings accounts.